Understanding Net Worth

Net worth is a fundamental financial metric that provides insights into an individual’s financial health. It is defined as the difference between total assets and total liabilities. In simple terms, net worth can be calculated by summing all of an individual’s assets, which typically include cash, real estate, investments, and personal property, and then subtracting their total liabilities, such as loans, credit card debts, and other financial obligations. This calculation yields a figure that represents an individual’s total wealth at a given point in time.

In the context of India, understanding how to calculate your net worth is essential, as it often serves as an indicator of financial stability and progress. It reflects an individual’s ability to manage their finances effectively and can influence decisions related to investments and savings. A positive net worth indicates that an individual has more assets than liabilities, which is generally a sign of good financial health. Conversely, a negative net worth suggests that liabilities exceed assets, signaling potential financial distress.

Moreover, tracking one’s net worth over time can be particularly beneficial for setting financial goals. Individuals can better assess their financial situation by regularly evaluating their net worth, allowing them to make informed decisions regarding investments, retirement planning, and purchasing large assets. It also provides a clearer picture when planning for future needs and aspirations.

Understanding the nuances of net worth calculation can significantly impact one’s financial journey. Therefore, learning how to calculate your net worth in India is not merely an academic exercise; it is a practical tool that can guide individuals toward achieving their financial objectives and fostering long-term wealth. Recognizing the balance between assets and liabilities is crucial for anyone aiming to improve their financial standing in an increasingly complex economic environment.

Identifying Your Assets

In order to understand how to calculate your net worth in India, it is essential to begin by identifying your assets. Assets are resources owned by an individual that can provide future economic benefits. The primary categories of assets include liquidity, investments, real estate, and personal property.

Cash and savings account balances are typically the most straightforward assets to evaluate. This includes physical cash and funds held in various savings or checking accounts. You should gather the current balances to represent this liquid form of wealth accurately.

Next, consider investments such as stocks, bonds, and mutual funds. You can evaluate the worth of these financial instruments by referring to current market prices listed on exchanges or reports from financial institutions. If you have retirement accounts or pension funds, their estimated values should also be included in your assessment.

Real estate is another significant category of assets. It encompasses residential properties, commercial real estate, or any land that you own. To determine the value of your real estate assets, consider using recent sales data of comparable properties in your area, or obtain a professional appraisal for a more accurate figure.

Moreover, valuable personal property such as jewelry, art, or collectibles should not be overlooked. While these items may not be liquid assets, they hold considerable value and should be evaluated accordingly. For a precise estimation, consider professional appraisals or online resources that can help you ascertain their market worth.

By systematically identifying and valuing these diverse categories of assets, you will establish a foundational understanding of how to calculate your net worth in India, enabling a clearer financial picture moving forward.

Listing Your Liabilities

When determining how to calculate your net worth in India, accurately listing your liabilities is crucial. Liabilities are any financial obligations or debts that you owe, and they play a significant role in assessing your overall financial health. Common liabilities that individuals may encounter include home loans, car loans, credit card debts, and personal loans.

Home loans are often one of the largest liabilities. When calculating this amount, consider the outstanding principal balance on your mortgage. It is essential to account for any additional costs such as property taxes or homeowner’s insurance that are related to maintaining the property. Next, if you own a vehicle, the remaining balance on your car loan must be included in your liabilities. This figure is important because it represents a fixed period of repayment that affects your financial standing.

Credit card debt is another significant liability. This type of debt can fluctuate, so it is prudent to take the latest outstanding balance into account. You should also consider the interest rates associated with these cards, as they can drastically increase the amount you owe over time. Personal loans, whether secured or unsecured, should also be assessed. These loans might include those taken out for emergencies, education, or other expenditures and should be factored into your calculation of financial obligations.

To accurately quantify your liabilities, gather statements and documents from financial institutions regarding all debts you hold. This ensures that your net worth calculation is based on the most recent and precise figures. By categorizing and listing these liabilities comprehensively, you will gain a clearer understanding of your overall financial picture, allowing you to calculate your net worth in India more effectively.

Calculating Your Total Assets

Understanding how to calculate your net worth in India begins with a comprehensive assessment of your total assets. This foundational step involves identifying various categories of assets and determining their current market values. Assets can range from tangible items such as real estate and vehicles to intangible assets like investments and savings.

To start, list all your significant assets. Real estate holdings represent a crucial portion of personal wealth. For accurate valuation, consider recent property sales in your area to gauge fair market value. Engaging a professional appraiser can also provide an objective assessment, giving you confidence in the figures recorded. In India, resources like online property portals can assist in analyzing current property prices and trends.

Furthermore, include financial investments such as stocks, bonds, and mutual funds in your asset calculation. For these items, access your investment accounts or consult financial statements to ascertain their current market values. The fluctuations in stock prices must be accounted for, using the most recent data to achieve an accurate figure. It is advisable to maintain a record of these values periodically, as it can significantly affect your overall net worth calculations.

Additionally, don’t overlook personal belongings that contribute to your financial portfolio. This can include high-value items such as art, jewelry, or collectibles, which may require appraisals for accurate valuation. Once you’ve compiled a comprehensive list of assets along with their respective market values, summing these totals will provide the first critical step towards understanding how to calculate your net worth in India.

Accurate assessment of total assets is essential for evaluating your financial standing. It ensures that subsequent steps in calculating net worth are based on a reliable foundation, allowing for an informed overview of your financial health.

Calculating Your Total Liabilities

Understanding how to calculate your net worth in India requires a clear assessment of your total liabilities. Total liabilities refer to all the debts and financial obligations you owe to creditors and lenders. This figure is essential as it directly impacts your overall net worth, which is calculated by subtracting total liabilities from total assets. To ensure accuracy, one must consider every form of debt, whether it’s short-term or long-term.

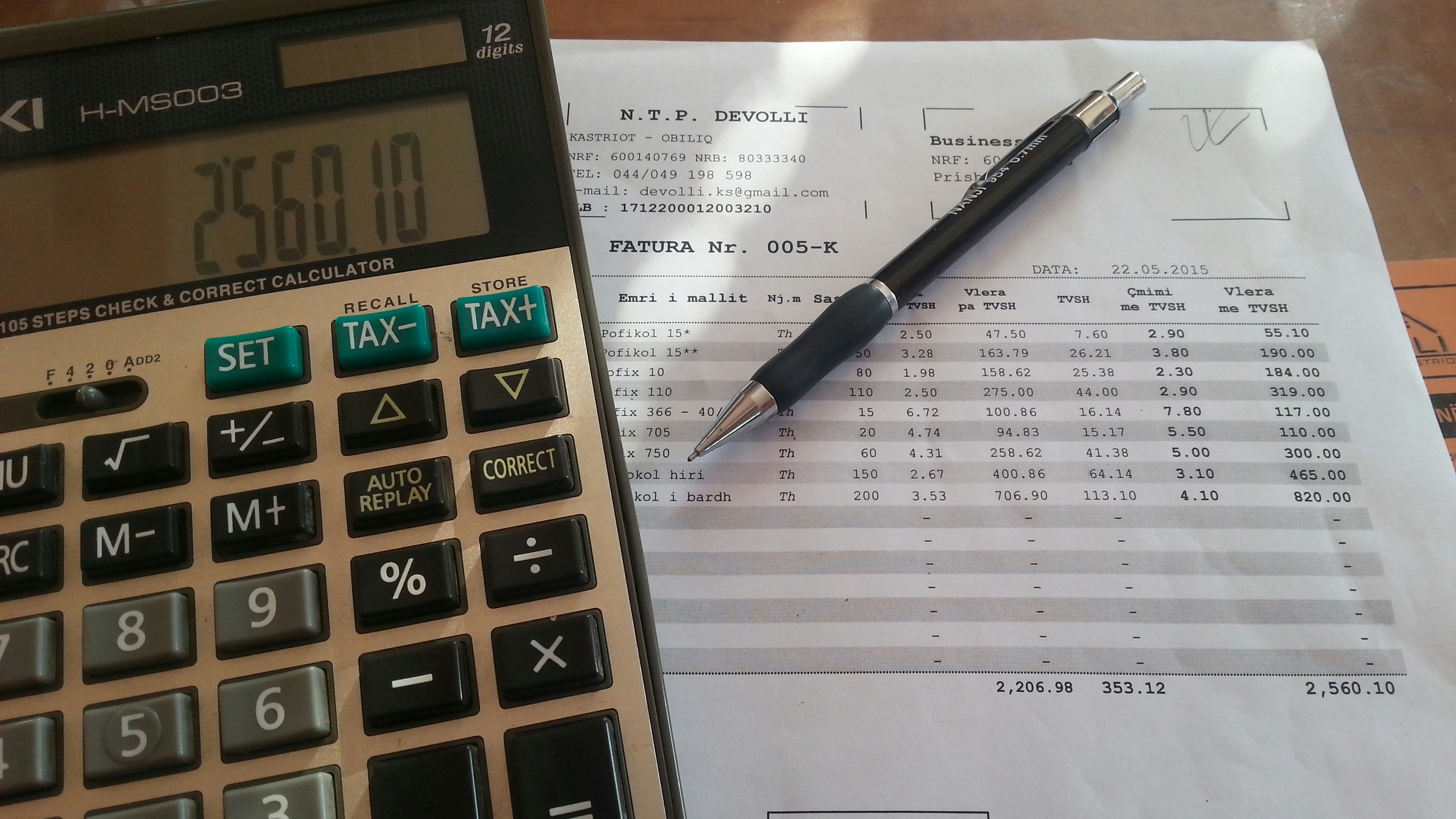

To begin calculating total liabilities, start by listing all outstanding debts. This may include personal loans, credit card balances, mortgages, auto loans, and any other loans. Once you have compiled this information, you can add them together to derive your total liabilities. For instance, if you have a home loan of ₹30 lakhs, an auto loan of ₹5 lakhs, and credit card debt of ₹1 lakh, your total liabilities would be ₹36 lakhs.

It is crucial not to overlook any liabilities; each debt contributes to the overall financial picture. While calculating, use this formula:

Total Liabilities = Sum of All Debts

After listing all liabilities, assess the corresponding amounts monthly, which can provide insights into your financial health. For effective tracking, maintaining an updated spreadsheet or using financial software can help in monitoring these liabilities over time. Furthermore, categorizing debts into secured and unsecured types may offer another layer of clarity. Secured debts have collateral backing them, such as mortgages, while unsecured debts, like credit cards, do not.

Ultimately, understanding how to calculate your net worth in India hinges significantly on the accuracy of your total liabilities. This process not only helps in evaluating your current financial standing but also lays the groundwork for better financial planning in the future.

Net Worth Calculation Formula

The calculation of net worth is essential for individuals seeking to understand their financial health. In essence, your net worth can be determined using a straightforward formula: Total Assets minus Total Liabilities. This formula serves as the foundation for assessing your financial standing. Total Assets include everything you own that has value, such as real estate, savings accounts, investments, and personal property. Conversely, Total Liabilities encompass all debts and financial obligations, including mortgages, loans, credit card balances, and other liabilities.

To apply this formula in the context of India, it is important to consider the unique financial circumstances that individuals may face. For instance, homeowners in urban centers might value their properties significantly differently based on the real estate market, while someone relying on mutual funds and stocks needs to account for fluctuating market values. Furthermore, individuals might have student loans or personal loans that need to be factored into their liabilities.

To illustrate how to calculate your net worth in India, let’s consider a hypothetical example: An individual owns a home valued at ₹50,00,000, has savings of ₹5,00,000, and holds investments worth ₹10,00,000. Therefore, Total Assets would equal ₹65,00,000. If this person has a mortgage of ₹30,00,000 and personal loans totaling ₹2,00,000, the Total Liabilities would be ₹32,00,000. As a result, their net worth in this scenario would be calculated as follows: ₹65,00,000 (Total Assets) – ₹32,00,000 (Total Liabilities) = ₹33,00,000.

In various financial scenarios, understanding how assets and liabilities intertwine provides clarity. Depending on your situation, adjusting the components of the formula enables you to grasp the true picture of your financial health and to implement smart financial decisions. This practical application of the net worth calculation formula can empower you on your journey towards better financial management.

Importance of Regular Net Worth Assessment

Understanding how to calculate your net worth in India is crucial for managing your financial health effectively. Regular assessment of one’s net worth not only provides a snapshot of your financial situation but also aids in making informed decisions that could significantly impact your future. By monitoring your net worth, you gain insights into your financial progress, which can be particularly beneficial when setting goals or planning for significant life events.

It is advisable to evaluate your net worth at least once a year. However, certain events such as marriage, purchasing a property, or nearing retirement may necessitate more frequent assessments. These milestones can lead to substantial changes in your financial landscape, which should be reflected in your net worth calculations. For example, acquiring a new home will increase your assets, while marriage may also bring about shared debts or assets that need to be considered in your assessment.

In addition to providing clarity on your current financial standing, regularly calculating your net worth can enhance your overall financial literacy. This process encourages individuals to acknowledge all aspects of their financial life, including assets such as real estate, savings accounts, and investments, while also considering liabilities like loans and credit card debts. Treating net worth calculation as a routine financial check-up ensures that you remain aware of shifts in your wealth status that may require adjustment in your spending, saving, or investing strategies.

The importance of tracking your net worth extends beyond mere numbers; it fosters a proactive approach to financial management. Understanding how to calculate your net worth in India equips you to better plan for future endeavors, prepare for emergencies, and achieve long-term financial stability.

Tools and Resources for Calculating Net Worth

In today’s digital age, leveraging technology to assess your financial situation has become increasingly accessible. Knowing how to calculate your net worth in India can be simplified through a variety of tools and resources available online. These tools can help individuals track their assets, liabilities, and overall financial status effectively. Below, we outline some popular options.

One highly recommended free resource is the Net Worth Calculator by Bankrate. This user-friendly tool allows users to input their assets, including properties and savings, alongside their liabilities like loans and credit card debts. Once the information is entered, the calculator provides a comprehensive view of one’s net worth, making it simple to understand where you stand financially.

Another excellent option for Indian users is Personal Capital, which not only helps in calculating net worth but also offers features for budgeting and investment tracking. This app provides a holistic financial overview, allowing users to visualize their assets, debts, and investments all in one place. The app is available on both iOS and Android platforms, enhancing accessibility.

For those willing to invest in a more specialized tool, YNAB (You Need A Budget) is a popular choice. Although it comes with a subscription fee, its robust features allow users to focus on their financial goals, helping to create a personalized plan for achieving financial wellness. YNAB provides detailed insights into spending habits, aiding users in making informed decisions about their money.

Additionally, websites like ClearTax and ET Money include net worth calculators as part of a broader suite of financial services. These platforms are tailored for the Indian market, ensuring that users receive relevant and localized financial advice. Utilizing these tools can significantly streamline the process of how to calculate your net worth in India, offering both clarity and a solid foundation for future financial planning.

Conclusion and Next Steps

Understanding how to calculate your net worth in India is essential for anyone aiming to achieve financial stability and growth. Your net worth serves as a comprehensive measure of your financial health, representing the difference between what you own and what you owe. By regularly assessing this metric, you can track your financial progress, make informed decisions regarding investments, and identify areas where you may need to focus your financial resources more efficiently.

Having calculated your net worth, the next logical step is to delve into effective financial planning. Begin by developing a detailed budget that reflects your income and expenditures. This will not only help you manage your money more effectively but also allow you to allocate funds towards paying off debts or increasing savings, which can positively impact your net worth over time. Consider utilizing budgeting tools or apps to assist in this process, which can simplify the tracking and adjustment of your financial habits.

Additionally, consider setting specific financial goals based on your net worth assessment. Whether it is saving for a home, planning for retirement, or establishing an emergency fund, aligning your goals with your net worth can provide a clearer roadmap to achieving financial success. It may also be beneficial to seek professional financial advice, particularly if you are unsure about the best strategies for maximizing your assets or minimizing liabilities.

In conclusion, calculating your net worth in India is a fundamental step towards gaining control over your financial future. By actively engaging in budgeting and financial planning grounded in your net worth assessment, you can foster financial discipline, make informed decisions, and ultimately enhance your financial well-being.