Understanding Your Monthly Income

To effectively manage monthly expenses with a ₹30,000 salary, the first step is to gain a comprehensive understanding of your total monthly income. This figure encompasses not only your primary salary but also any supplementary sources of income you may have. This could include freelance work, rental income, investments, or any other financial inflows that can contribute to your monthly budget.

Start by calculating your gross income by identifying all the ways you earn money each month. For instance, if your base salary is ₹30,000, and you have an additional ₹5,000 income from side jobs, your total income would then amount to ₹35,000. It is essential to have a clear view of all your earnings, as this will allow you to make informed decisions about your expenditure and savings.

After establishing your total income, the next crucial step is to determine your take-home pay. This step involves accounting for any taxes and deductions that apply to your salary. Deductions may include income tax, provident fund contributions, or any other mandatory charges that reduce the amount you receive every month. For instance, if you have a tax deduction of ₹2,000 and a provident fund contribution of ₹1,500, your take-home pay would be ₹26,500, which is your usable salary for managing monthly expenses.

Having clarity on your take-home pay is vital as it represents the actual amount available for budgeting. This insight equips you with the necessary information to allocate funds effectively across different areas such as necessities, savings, discretionary spending, and debt repayments. By understanding both your total income and your take-home amount, you can gain a clearer perspective on how to manage monthly expenses with a ₹30,000 salary, ensuring a well-structured financial plan.

Identifying Essential and Non-Essential Expenses

Effective financial management is crucial, especially when working with a budget constrained by a ₹30,000 salary. One of the most important steps in this process is differentiating between essential and non-essential expenses. Essential expenses, often referred to as needs, typically include items that are necessary for daily living and functioning. Common examples include rent, groceries, utilities, transportation, and healthcare. These expenses are unavoidable and must be prioritized in your monthly budget.

On the other hand, non-essential expenses, or wants, encompass those expenditures that enhance quality of life but are not critical for day-to-day survival. These might include entertainment activities, dining out, subscription services, and luxury items. Understanding the distinction between these two categories is key to financial stability. This becomes increasingly significant when managing monthly expenses with a ₹30,000 salary, as allocating funds wisely can prevent overspending in areas that do not significantly impact well-being.

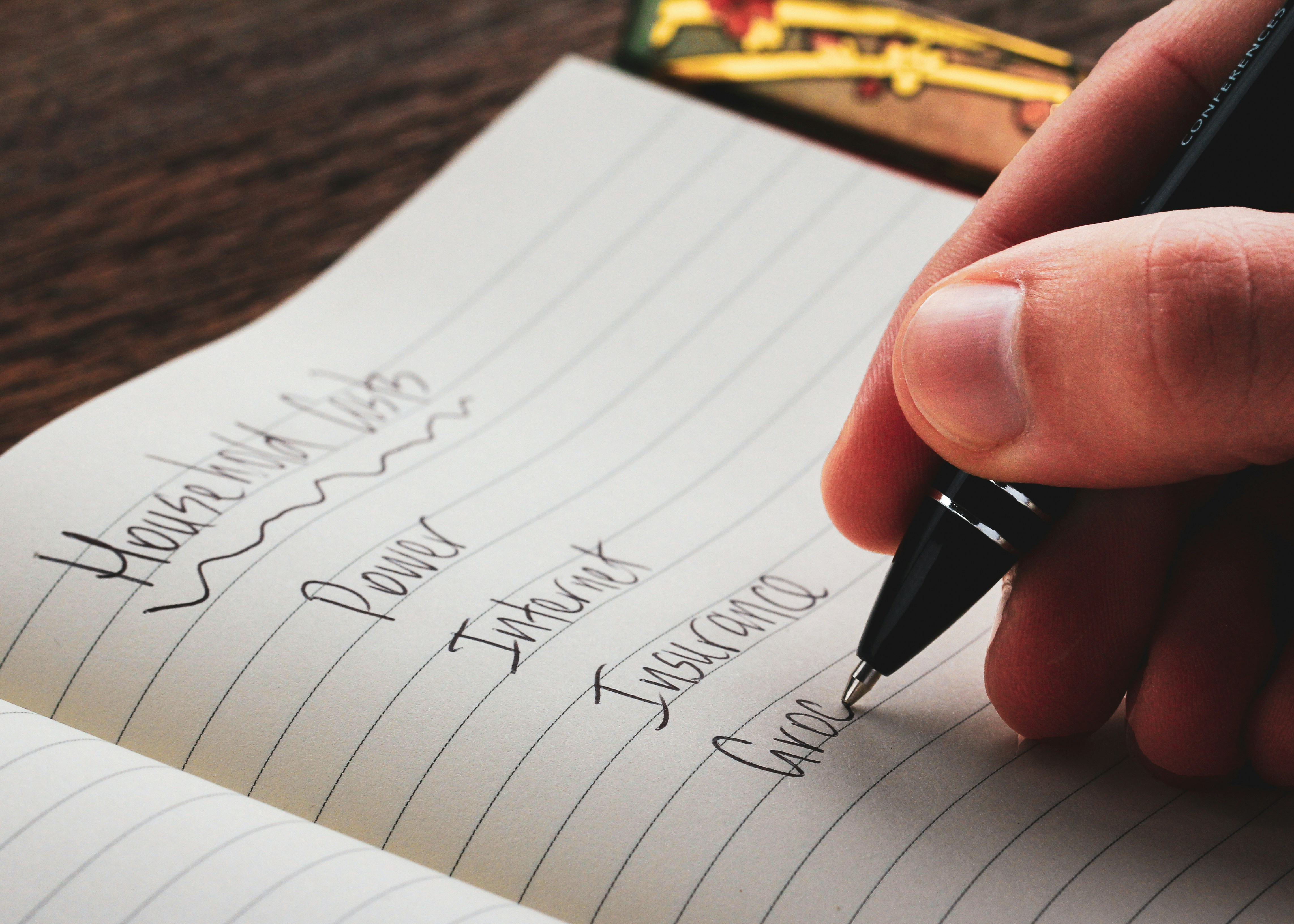

To effectively categorize your expenses, keeping a detailed record of all monthly spending can be beneficial. Reviewing your bank statements or using budgeting tools can help identify patterns in spending. Once your expenses are outlined, consider creating a simple list. Highlight essential items that must be funded first and include a secondary list for discretionary spending. Striving to limit non-essential expenditures to a manageable portion of your budget will allow for greater flexibility and savings in the long term.

Ultimately, adopting a disciplined approach towards identifying and prioritizing your essential versus non-essential expenses can guide towards more effective financial management. This clarity makes it significantly easier to devise a practical budget that accommodates your monthly income, ensuring that you can live comfortably within a ₹30,000 salary while still enjoying occasional luxuries responsibly.

Creating a Monthly Budget

Establishing a well-structured monthly budget is paramount for anyone aiming to manage their finances effectively, particularly when working with a ₹30,000 salary. A budget serves as a financial blueprint, guiding individuals in tracking their income and expenditures systematically. One popular method to create a practical budget is the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. This framework allows individuals to prioritize necessary expenses while still enjoying some discretionary spending.

To begin crafting a monthly budget, start by listing all sources of income, followed by a detailed breakdown of monthly expenses. Expenses can be categorized further into fixed costs (such as rent, utility bills, and loan payments) and variable costs (such as groceries and entertainment). Assessing these categories will help individuals understand where their money goes each month and identify areas for potential savings.

In addition to the 50/30/20 rule, a variety of budgeting tools and apps are available that can simplify this process. Options like Mint, YNAB (You Need A Budget), and PocketGuard allow users to track expenses in real-time, categorize spending, and set budget goals. These technological aids not only create a visual representation of financial standing but can also send alerts when nearing spending limits in certain categories.

Visual aids such as sample budget templates can also be beneficial. These templates could provide a clear overview of how to allocate a ₹30,000 salary effectively, making it easier for users to replicate and adjust according to their unique financial situations. By following a structured approach to budgeting, individuals will be better equipped to manage their monthly expenses and work towards financial stability.

Tracking Your Spending

Effectively managing your finances, particularly when living on a ₹30,000 salary, requires diligent tracking of your spending habits. One of the foundational steps in how to manage monthly expenses with a ₹30,000 salary is to maintain a spending diary. This method involves recording every single transaction made throughout the month, from grocery shopping to small incidental purchases. By physically writing down these expenses or using a digital format, individuals can gain valuable insights into their spending patterns.

Another effective approach is to utilize mobile applications designed for budgeting and expense tracking. Numerous apps available today can help users categorize their expenses and visualize their financial situation. Many of these applications offer features such as reminders for bill payments, categorization of expenses, and reports that reflect spending trends. This not only simplifies the process of tracking but can also motivate individuals to adhere to their budget effectively.

Additionally, reviewing bank statements regularly plays a crucial role in keeping track of expenses. Monthly bank statements provide a comprehensive overview of all transactions made during the month, allowing individuals to pinpoint areas where they might be overspending. By cross-referencing these statements with the spending diary or app, one can identify discrepancies and areas for improvement.

It is important to note that tracking expenses is not just about recording what has been spent but also involves reflecting on those spending habits regularly. Accountability is vital in managing finances. By understanding where the bulk of their money is going, individuals can make informed decisions about their spending, ultimately aiding in the challenge of how to manage monthly expenses with a ₹30,000 salary.

Finding Ways to Reduce Expenses

Successfully managing monthly expenses with a ₹30,000 salary requires a strategic approach to identify and eliminate unnecessary costs. One of the first areas to assess is grocery shopping. Planning meals for the week and creating a shopping list can help avoid impulse buys. By purchasing items in bulk, particularly non-perishables, you can often benefit from lower prices. Additionally, consider utilizing discount supermarkets or local markets where seasonal produce is frequently less expensive.

Another significant expense is utilities, which can vary based on usage. To mitigate these costs, adopting energy-efficient practices is essential. Simple actions such as unplugging devices when not in use, switching to LED bulbs, and utilizing natural light can lead to substantial savings over time. Moreover, reviewing utility bills for errors or switching providers can provide further financial relief. It is also advisable to monitor water consumption by fixing leaks and conserving use to lower monthly bills.

Transportation is another critical factor in controlling monthly expenses. If possible, use public transport or consider carpooling to reduce fuel expenses. If owning a vehicle is necessary, regular maintenance can prevent costly repairs later on. Furthermore, explore options such as walking or cycling for short distances, which not only cuts costs but also benefits overall health.

Seeking out discounts, using coupons, and leveraging loyalty programs are additional strategies to enhance savings. Many retailers offer discounts for signing up for newsletters or downloading apps. Engaging with these savings opportunities can further stretch a ₹30,000 salary. By remaining vigilant and adaptable in daily expenditure habits, one can significantly improve their financial situation and efficiently manage monthly expenses.

Setting Financial Goals

Establishing financial goals is a crucial step in the journey of managing monthly expenses with a ₹30,000 salary. By clearly defining both short-term and long-term objectives, individuals can channel their spending patterns towards meaningful outcomes. Short-term goals may include creating an emergency fund, while long-term goals can focus on significant milestones such as saving for a home or funding education. These objectives serve as motivation to adopt better financial habits and make informed decisions regarding expenditure.

To initiate the goal-setting process, one should begin by assessing current financial situations, including regular income, monthly necessities, and discretionary spending. From there, it is beneficial to develop SMART goals—specific, measurable, achievable, relevant, and time-bound. For instance, one might aim to save ₹5,000 within six months for an emergency fund, which can create a safety net against unforeseen expenses. Such clarity will not only guide monthly budgeting but also provide a sense of accomplishment as milestones are reached.

Furthermore, financial goals need to be aligned with one’s lifestyle and aspirations, inspiring commitment to prudent financial management. Evaluating and revisiting these goals periodically ensures that they remain relevant and attainable, adapting to changes in personal circumstances or market conditions. A well-crafted goal also acts as a psychological anchor, helping to fend off impulsive spending while reinforcing discipline.

By effectively setting and pursuing these financial goals, individuals can empower themselves to manage their monthly expenses with a ₹30,000 salary more effectively. This proactive approach aims at fostering a balanced, constructive financial future while nurturing positive spending habits along the way.

Dealing with Unexpected Expenses

Unexpected expenses can significantly impact anyone’s budget, and managing these costs is especially crucial when working with a limited income, such as a ₹30,000 salary. Emergencies can arise from various sources, including medical situations, urgent repairs, or unexpected travel needs. Hence, it is essential to have a plan in place to mitigate the financial strain of such incidents.

One of the most effective strategies for preparing for unforeseen costs is to establish an emergency fund. This fund acts as a financial buffer, enabling you to address sudden expenses without derailing your monthly budget. Start by assessing your current financial situation and determining a realistic amount to set aside each month. Even putting away a small sum—like ₹1,000—can accumulate over time, providing you with critical funds during emergencies.

To build your emergency fund while managing a ₹30,000 salary, consider several practical approaches. First, evaluate your spending habits and identify areas where you can potentially cut back. This could include minimizing discretionary expenses such as dining out, entertainment, or subscription services. Redirecting these savings into your emergency fund can accelerate its growth. Additionally, consider engaging in side gigs or freelance work that aligns with your skills, which can generate extra income to bolster your financial security.

Furthermore, staying organized and keeping a close eye on your monthly expenses will help you maintain awareness of your financial health. Regularly reviewing your budget can aid in identifying any areas that require adjustment, making room for contributions to your emergency fund. By conscientiously managing your monthly expenses and prioritizing the establishment of this fund, you can adeptly handle unexpected expenses while on a modest salary.

Reviewing and Adjusting Your Budget

Managing monthly expenses effectively is critical, especially when dealing with a salary of ₹30,000. One of the most essential practices you can adopt is regularly reviewing and adjusting your budget. This process involves taking a close look at your income and expenses to ensure that your financial plan aligns with your current situation. Failing to do so can lead to overspending or a lack of direction in your financial management.

To begin, assess your current budget by examining your fixed and variable expenses. Fixed expenses include rent, utilities, and loans, which tend to remain constant month-to-month. Variable expenses, such as groceries and entertainment, may fluctuate. By tracking these expenditures, you can identify patterns and areas where adjustments may be necessary. For instance, if you notice that your grocery bills are consistently over budget, consider exploring cheaper options or meal planning to reduce costs.

Additionally, monthly financial situations can change due to unexpected expenses or alterations in income. Therefore, it is crucial to revisit your budget regularly—ideally monthly. This allows you to adapt to any changes, ensuring that you are always living within your means. If you are earning a higher income this month or perhaps incurring unexpected medical bills, a prompt budget adjustment will help maintain financial stability. This proactive approach in learning how to manage monthly expenses with a ₹30,000 salary enables you to make informed decisions that can positively impact your overall financial landscape.

Creating a flexible budget not only supports the management of monthly expenses effectively but also promotes a mindset of financial awareness. Being actively engaged with your finances enhances your ability to navigate future changes in your economic circumstances. Track your progress and make adjustments as necessary to stay on top of your financial goals.

The Importance of Financial Literacy

Financial literacy plays a critical role in effectively managing monthly expenses, especially when living on a limited income such as a ₹30,000 salary. Understanding basic financial principles can empower individuals to make informed decisions about budgeting, saving, and spending. Knowledge of concepts like cash flow, needs versus wants, and the implications of debt can provide individuals with the tools they need to navigate their financial situations more confidently.

Moreover, having a solid grasp of financial literacy allows one to better understand financial products and services available in the market. For example, individuals can discern between different bank accounts, loans, and investments, enabling them to select the most suitable options based on their financial circumstances. This informed decision-making is essential in avoiding unnecessary expenses and maximizing savings, which is vital for anyone working with a ₹30,000 salary.

Numerous resources are available for those looking to enhance their financial understanding. Various books, such as “The Total Money Makeover” by Dave Ramsey and “Rich Dad Poor Dad” by Robert Kiyosaki, provide readers with foundational financial knowledge. Additionally, an array of online courses offered by platforms like Coursera and Udemy cover topics ranging from budgeting tactics to investment basics. These courses often allow individuals to learn at their own pace and tailor their education to their specific needs.

Community workshops also serve as a valuable resource for improving financial literacy. Many non-profit organizations and local libraries host sessions that cover essential topics related to money management. Engaging with others in similar financial situations can inspire new ideas and strategies for how to manage monthly expenses with a ₹30,000 salary effectively.

In conclusion, financial literacy is indispensable for anyone aiming to control their monthly expenditures. By leveraging available resources to build knowledge and skills, individuals can enhance their financial well-being and achieve greater stability, even within the constraints of a modest salary.